Previously published on Inman News

Key Takeaways

• Threats to the broker-centric model from alt-brokerages, portals are real and growing.

• But brokers have under-appreciated, underutilized assets that can be used to fight back.

• On top of historical and legal advantages, network and data mark a significant opportunity.

–

January is a time for predictions for the year ahead — and this year, strangely, I’ve noticed a sense of pessimism surrounding the broker-centric model of real estate.

To many, it seems as if the end of brokers is near. Yet as I spend time with brokerage executives and study technology trends, I come to a completely different conclusion. The doom and gloom is unwarranted.

Here’s why: Threats to the brokerage-centric model are, of course, real and growing, but the rhetoric that brokers are not in control of their future viability ignores the distinct and powerful advantages brokers have against their specific and systematic competitors.

By leveraging these advantages and assets, in 2020 and beyond, brokers can, and will, reassert their position as the center of the real estate industry.

Unwarranted pessimism?

Let’s take a quick look at the trends threatening the brokerage value proposition. The first to come to mind is the brute-force strategy for capital-rich companies (such as Compass) to flood the agent recruiting market with cash. Regardless of this model’s long-term sustainability, it’s broken traditional agent recruiting paradigms and raises some fundamental questions about broker value propositions.

Another area of disruption is broker-provided technology and marketing infrastructure. Portals are aggressive in providing increasingly valuable agent tools for “free,” not only eroding the value of broker-provided technology and marketing tools in the eyes of agents, but also affecting consumer perception of real estate brands.

Will the day come when being a “Zillow Premier Agent” is as valuable as being a “Coldwell Banker agent”?

Alternative model brokerages (or alt-brokerages) also threaten incumbents, with companies like Redfin and Opendoor going after consumer attention directly. Clearly, these companies have only made a small dent in the overall market, but as they gain further economies of scale and network effects, their impact will only grow.

These pressures on agent recruiting, broker-provided tools, and consumer attention threaten the brokerage status quo and is driving the surge of pessimism.

These Inman headlines from the last 18 months tell the story: “Why the broker-centric model is in decline,” “Is traditional brokerage model obsolete?” “The real estate broker model is broken.”

This pattern goes beyond opinion and rhetoric, however. It’s no coincidence that the frequency and magnitude of venture capital funding into disruptive real estate technology has accelerated in recent years.

Smelling blood, investors have placed bets on companies that seek to slash and burn the current real estate model. Compass and Opendoor have raised over $200 million and $300 million, respectively, and a flood of early stage startups like SideDoor, Reali and Open Listings have entered the market as well.

Taken together, one can’t be blamed for worrying about broker obsolescence.

I, for one, reject this narrative.

Untapped broker assets

I am a cautious optimist. Yes, the broker-centric model is facing serious threats in the industry, and I don’t mean to diminish their importance.

On the other hand, journalists, venture capitalists and even brokers themselves have undervalued the fundamental strengths that brokers have — to not only stave off existential threats, but to also find new opportunities ahead.

Most obviously, the broker is still, and will continue to be, the legal and transactional center of real estate.

This is not a trivial advantage.

Executional experience in risk-management, regulatory maneuvering and financial strategy — especially in a hyper-local industry — are not things that alt-brokerages or tech startups can garner in just a few years, no matter how much cash they try to throw at the problem.

The cultural and personal aspects of the broker-centric model can’t be ignored, either. Brokerages are meaningful sources of agent training, collaboration and community — they are central to how agents run their business.

Consumers clearly value and discriminate by brokerage brand, services and relationships, as seen in the dominance of traditional and local brands dominating most marketplaces.

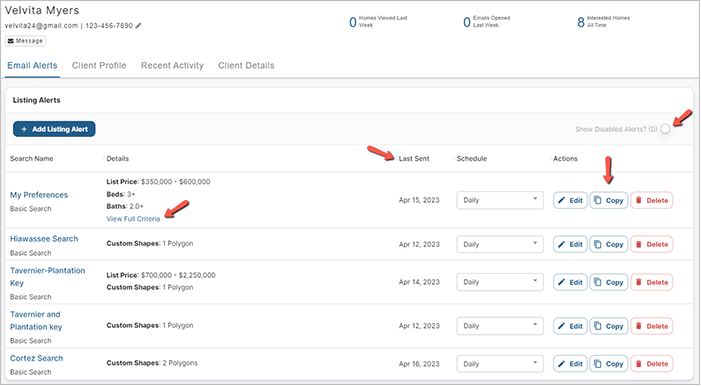

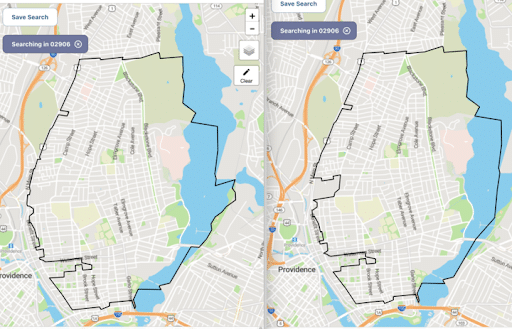

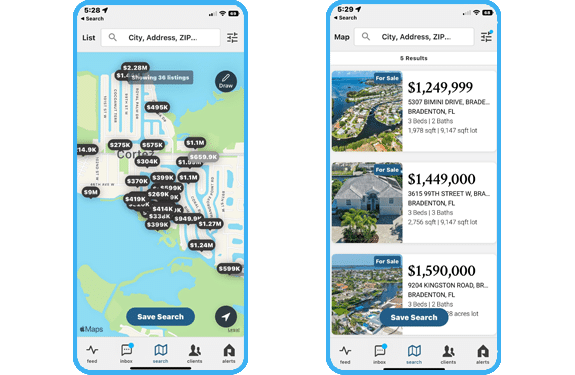

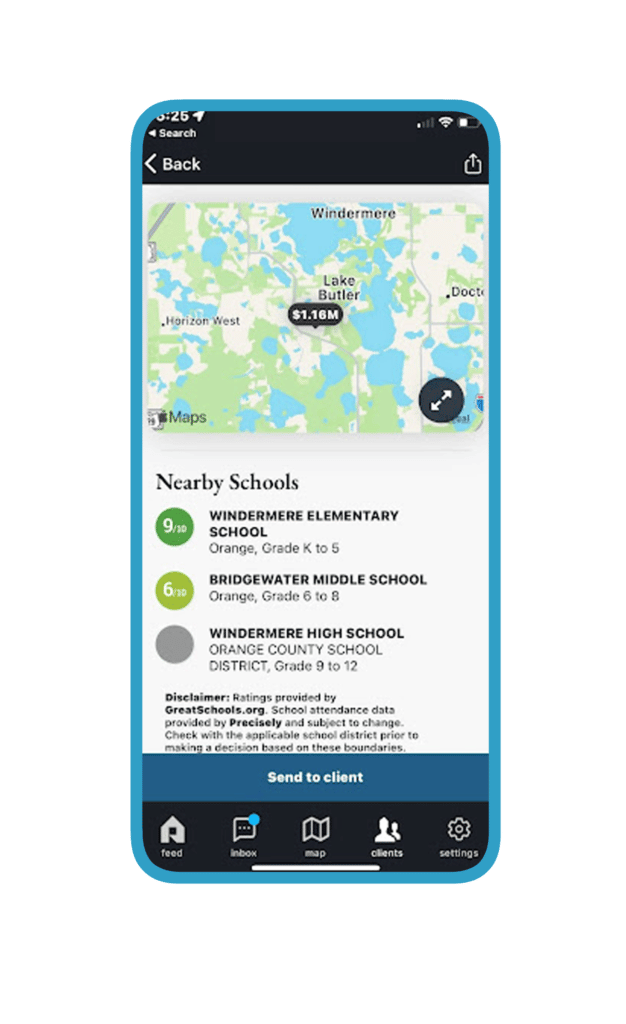

The most under-appreciated and underutilized asset in a broker’s arsenal is the network and data.

The concept of a broker’s network isn’t anything new — it’s the collective spheres of influence of a broker’s agents. A broker with a large, high-quality network has an powerful platform to leverage for their business, and importantly, it’s a network that by definition, cannot be replicated elsewhere.

This network is the moat that protects brokers who choose to make it a strategic focus.

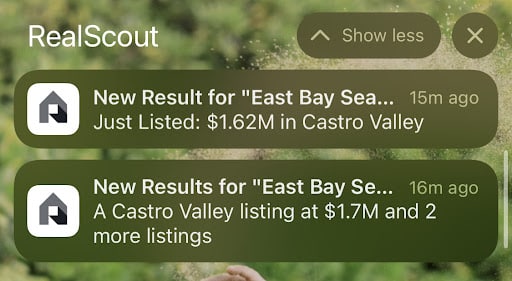

As a byproduct of this network, brokers have exclusive access to an incredibly valuable data-set of real estate listings, consumers and transactions, all of which are ready to be tapped for growth.

By managing and leveraging their existing network and data asset, they can drive transactions, win listings and even recruit more agents. This is the massive opportunity for brokers to solidify their footing at the center of the real estate universe.

There is a nuance when it comes to network and data, however. Too often, brokers don’t have the capacity to capture the network, extract the data and fully utilize it to their advantage. It’s like sitting on a diamond mine; without the necessary mining machinery, it’s little more than a pile of rocks.

It’s second-nature for brokerage executives to know exactly how many listings their agents won in the last month, but seldom do they know how many active buyers are affiliated with their agents at any given point. This blind spot, among others, keeps brokers from realizing the true value of their network and regaining their strategic edge in the market.

Year of the broker

As with any advantage, these aren’t evergreen. Regulations change, consumer sentiment evolves, and brokerage market share shifts. Yet in my view, in the near future and certainly in 2020, these advantages and assets are still robust and are ready to be extracted.

With the right strategy, partners and tools, brokers can, and have an obligation to, take control over their own destiny — not defensively, but by playing offense against their threats, making the most of the opportunities ahead. The broker head-start is still huge, especially in their network, and I’m optimistic.

2020 is the year of the broker, and it’s just the beginning of a bright future.