In previous articles, I’ve talked about how buyer data is leading to a gold rush in the real estate industry, and how buyer data is revolutionizing how we do business.

A common observation in both is that brokerages and traditional real estate professionals are behind the curve in this buyer data land grab. Losing this battle means that brokerages and agents could lose control over their transaction supply and demand, thus weakening their position in the ecosystem.

So let’s explore the 3 reasons why brokerages are at a disadvantage today:

1. Brokerages don’t control where buyers search for homes

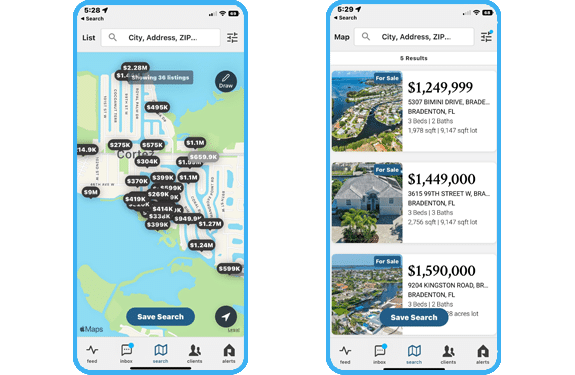

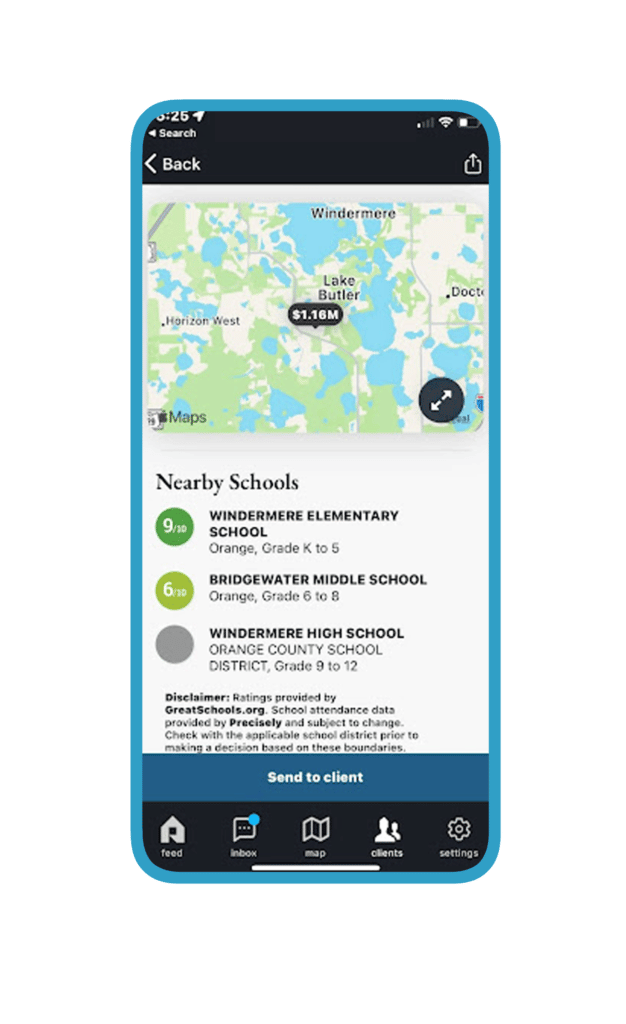

The most fundamental problem is that traditional real estate brokerages don’t control where their buyers are searching for homes. As NAR Surveys show year after year, real estate consumers are digital natives, conducting a majority of their home search and decision-making online or on mobile.

Real estate brands however, don’t control these digital channels. Most of the time, consumers are looking for homes either on a portal site like Zillow or Realtor.com, alt-brokerage websites like Redfin or Movoto, or on their local MLS website.

The problem is straightforward. None of these channels are controlled by brokerages, thus all the valuable information a buyer generates about their purchase behavior either gets lost, or worse, it gets collected by a competitor.

“Valuable information a buyer generates about their purchase behavior either gets lost, or worse, it gets collected by a competitor.”

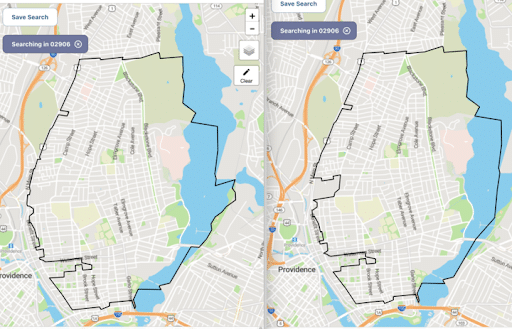

Brokers and agents therefore, need to find a home search platform that they control, and importantly, one that consumers will choose to use.

2. Brokerages don’t know how to collect buyer data

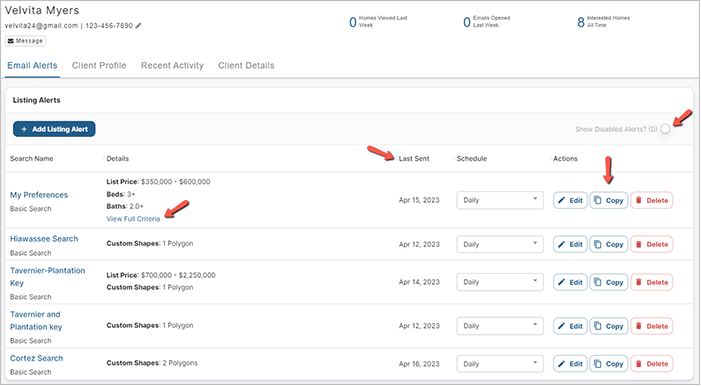

Even for forward-thinking real estate brands with a strong home search experience, many don’t know how to collect actionable insights from their buyer’s search behavior.

This isn’t the brokerages fault, however. Extracting actionable data from user-behavior is a highly technical and arduous task that requires dedicated engineers and data scientists. While some of the largest brands may be able to field a team of experts, most brokerages would be hard-pressed to make that commitment.

“Extracting actionable data from user-behavior is a technical and arduous task that requires dedicated engineers and data scientists.”

Of course, the same non-brokerage technology players mentioned above are also fielding expert teams to make sense of buyer data. Unfortunately, not many of these companies are opening this capability to brokerage customers.

3. Even with buyer data collected, brokerages don’t know how to act on it

Leveraging buyer data for real estate business is still a cutting-edge discipline, and most companies don’t have the infrastructure or tools to take advantage of the opportunity.

Let’s examine the most basic use-case: marketing a listing. It’s common at brokerage sales meetings for listing agents to stand up and describe their new listing, asking whether their colleagues have relevant buyers. This is perhaps one of the most inefficient forms of listing marketing, and buyer data can transform this experience.

If a brokerage 1) captured their buyers, 2) collected the buyer data, and 3) had the right tools, listing agents can actively identify buyer agents within their brokerage that match their listing. So instead of standing up during a poorly attended sales meeting, they can send a personalized message to the most relevant buyer agents, no matter which office they belong to. While straightforward, the effectiveness is night and day.

Obviously, there are hundreds of other ways that a brokerage can take advantage of buyer data, ranging from business intelligence, marketing, and recruiting, but each requires technical work and a product know-how to execute.

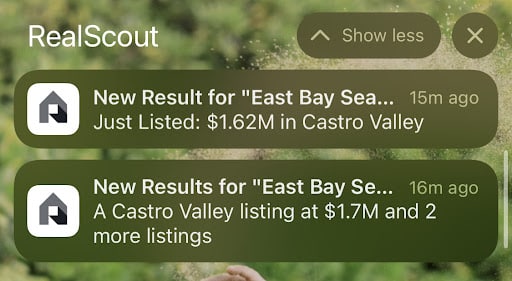

There are extremely few solutions in the marketplace that will help brokerages fight back in this battle for buyer data. Platforms like RealScout are some of the only solutions that effectively solve all 3 problems for brokerages.

While real estate brands may have gotten a late start in the battle for buyer data, with the right mindset, technology, and long-term partners, there’s still time for a decisive comeback.

About RealScout

RealScout (www.realscout.com) is the brokerage and agent-branded home search platform that empowers agents and their clients to find the right home faster. RealScout supports the competitive needs of brokerages and agents by helping them work in concert with their clients throughout their property hunt. Homebuyers receive exclusive personalized property matches based on their specific lifestyle and feature preferences. Agents have visibility into buyer activities to best meet evolving client preferences, boosting client loyalty and facilitating informed, data-driven decisions that generate more offers in less time.