Vanguard Properties and other San Francisco brokerages built a unique tech ecosystem to forge a path for long-term success

- By Andrew Flachner

Amid a tumultuous and unpredictable year, real estate’s playmakers innovated at record pace and deployed new strategies that are redefining the future of the industry. Blink, and you might have missed some of these seismic shifts this year:

- Q1: the implementation of NAR’s Clear Cooperation policy, a response to walled-garden listing data strategies that rose to prominence in 2019.

- Q2: the pandemic necessitated the deepening of remote home buying/selling, a massive acceleration of a trend already in motion for many years.

- Q3: Zillow’s announcement to harness its dominance with consumers to broker their own iBuyer transactions.

- Q4: a major new player entered residential real estate with CoStar’s acquisition of HomeSnap, providing the $34B company access to one of the biggest real estate audiences in the country.

These developments represent the breakdown of long-held assumptions, yet another wave of talent and capital entering the space, and a consequential shift in economic and operational power throughout the landscape.

Meanwhile, despite the climate of uncertainty, leaders have met these challenges by deploying their own long-term strategies, taking an objective look at their own strengths and doubling down on the unique opportunities presented to them as a leading brokerage.

One such leader is Nina Dosanjh of Vanguard Properties, a forward thinking, independently owned and operated brokerage based in San Francisco. For years, Vanguard Properties has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

One such leader is Nina Dosanjh of Vanguard Properties, a forward thinking, independently owned and operated brokerage based in San Francisco. For years, Vanguard Properties has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

A key benefit of a strong technology experience is the ability to engage and therefore secure both clients and agents to the brokerage. Many of the developments seen in 2020 have a common theme around the control of consumer attention. Whether at the lead-gen phase, the home search phase, or the transaction management phase, new entrants in the market understand the critical importance of making sure real estate consumers are engaged on first party platforms. Dosanjh shares this view, and sees a strong brokerage-owned consumer technology ecosystem as table-stakes to compete in the evolving marketplace.

Deploying powerful agent/client collaboration tools is a simple, yet powerful, starting point to engage consumers and keep them in the agent and broker ecosystem. These tools lead to higher lead-conversion and the ability for agents to manage a higher volume of clients. Furthermore, the engagement these tools create ensures brokerages are well positioned to harvest the byproducts of increased repeat and referral business, and the most valuable opportunity of all: data.

Examining the developments in 2020, it’s clear that they don’t revolve around the traditional brokerage ecosystem or business practices, despite the fact that the incumbent model is still the center-of-gravity of the industry as a whole.

As with almost any other technology experience, user engagement and data are inseparable in real estate. The key observation made by Dosanjh and others, is that there’s a big disconnect in real estate consumer data where the owner of the client relationship – the agent and brokerage – typically don’t have access or control of the client data that is generated. A consumer may work with an agent to buy or sell a home, but because they use 3rd party technology, the agent has no visibility into the technology usage, let alone the ability to then add further value to the consumer using real-time data.

This is another reason why a RealScout-facilitated data strategy was a good fit for Vanguard Properties’s vision, since the platform is designed for secure yet transparent handling of client behavior and preference data. Instead of giving away this critical asset to 3rd party portals, agents using RealScout can better understand and serve their clients. Vanguard Properties also has more visibility into their client base and therefore the overall health of their business.

While this initiative seems to apply solely to Vanguard Properties, a single brand, Dosanjh’s strategic analysis points to a broader opportunity that encompasses a larger pool of brokerages. Examining the developments in 2020, it’s clear that they don’t revolve around the traditional brokerage ecosystem or business practices, despite the fact that the incumbent model is still the center-of-gravity of the industry as a whole. The simple yet powerful conclusion is that by doubling down on their strengths, brokerages and agents can unlock opportunities far greater and more tangible than some of the long-shot bets made in 2020.

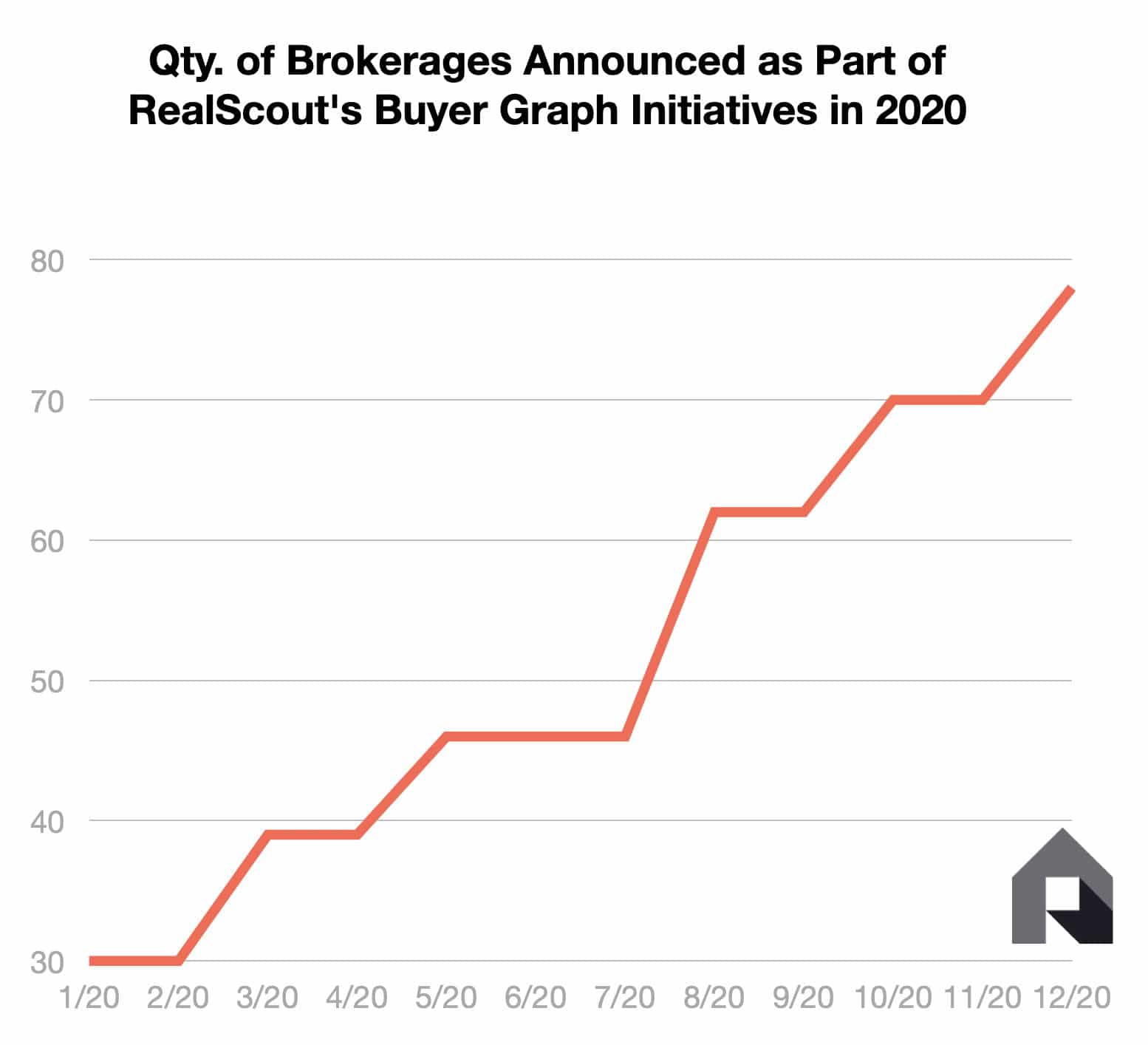

A concrete example of this rallying cry is Vanguard Properties’s decision to anchor the San Francisco Buyer Graph Initiative. The Initiative brought together the leading brokerages in San Francisco to build an open platform that securely and thoughtfully shares the engagement data generated on RealScout. In doing so, the brokerages get a deeper insight into the market as a whole, deepen inter-brokerage collaboration, and ultimately deliver a more data-driven, sophisticated home buying experience to clients.

Nearly 50,000 agents are now part of these initiatives, providing access to insights and decision-making tools unavailable anywhere else.

These initiatives have reached beyond the San Francisco market, popping up in markets such as Tahoe and Reno, New England, Washington DC, North Carolina and Philadelphia in 2020 alone. Nearly 50,000 agents are now part of these initiatives providing access to insights and decision-making tools unavailable anywhere else.

Even the most unpredictable element of 2020, the global pandemic, was something Dosanjh and Vanguard Properties were prepared for thanks to the initiatives described above. A best-in-class collaborative technology was exactly what agents and clients needed during remote transactions, and for Vanguard Properties, the results speak for themselves.

What’s striking about the strategy set forth by leaders such as Dosanjh is its simplicity and consistency. By focusing on the singular goal to provide the best possible first party client experience, an experience that intimately involves client/agent collaboration, Dosanjh has been successful in responding to big industry trends, even larger macro-economic challenges, all the while elevating Vanguard Properties’s ability to serve its clients.

Although 2021 may prove to be just as unpredictable as 2020, the lesson learned from leaders such as Dosanjh is that blindly chasing and reacting to trends is not the key to success. Instead, a simple, consistent, potentially contrarian vision, carefully formulated and boldly executed will protect against busts and accelerate booms.

One such leader is Phillip Cantrell of Benchmark Realty, a full service, 100% commission brokerage based in the Greater Nashville area. For years, Benchmark Realty has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

One such leader is Phillip Cantrell of Benchmark Realty, a full service, 100% commission brokerage based in the Greater Nashville area. For years, Benchmark Realty has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

One such leader is Joan Docktor of Berkshire Hathaway HomeServices Fox & Roach, the leading real estate brokerage in the Tri-State area and a part of HomeServices of America, largest residential brokerage company in the United States. For years, BHHS Fox & Roach has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

One such leader is Joan Docktor of Berkshire Hathaway HomeServices Fox & Roach, the leading real estate brokerage in the Tri-State area and a part of HomeServices of America, largest residential brokerage company in the United States. For years, BHHS Fox & Roach has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

One such leader is

One such leader is

One such leader is Anthony Lamacchia of Lamacchia Realty, a leading brokerage based in New England. For years, Lamacchia Realty has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

One such leader is Anthony Lamacchia of Lamacchia Realty, a leading brokerage based in New England. For years, Lamacchia Realty has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

One such leader is Heidi Pay, Chief Operating Officer of Golden Gate Sotheby’s International Realty, a luxury brokerage based in the Bay Area. For years, Golden Gate Sotheby’s has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

One such leader is Heidi Pay, Chief Operating Officer of Golden Gate Sotheby’s International Realty, a luxury brokerage based in the Bay Area. For years, Golden Gate Sotheby’s has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

One such leader is Jeff Adams of Helen Adams Realty, an independent, local brokerage serving the greater Charlotte North Carolina and upstate South Carolina areas. For years, Helen Adams Realty has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

One such leader is Jeff Adams of Helen Adams Realty, an independent, local brokerage serving the greater Charlotte North Carolina and upstate South Carolina areas. For years, Helen Adams Realty has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

One such leader is Amy Bayer of PorchLight, one of the largest independent, locally owned brokerages serving Denver, Boulder and the metro areas. For years, PorchLight has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

One such leader is Amy Bayer of PorchLight, one of the largest independent, locally owned brokerages serving Denver, Boulder and the metro areas. For years, PorchLight has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

Two such leaders are Sam Khorramian and Oliver Graf of Big Block Realty, a 950-agent brokerage in San Diego. For years, Big Block Realty has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.

Two such leaders are Sam Khorramian and Oliver Graf of Big Block Realty, a 950-agent brokerage in San Diego. For years, Big Block Realty has been a vocal and active advocate for delivering best-in-class tech experiences for their clients and agents. This conviction is motivated not only by the need to fulfill modern technology needs, but also by the prediction that such robust brokerage platforms act as both defense and offense against disruptive changes in the industry.