How agents are unlocking “latent listings” by reducing seller uncertainty

THE LAST 12 MONTHS have been marked by unprecedented low inventory, with the pandemic and the ensuing economic uncertainty reinforcing a long term trend of dwindling listing opportunities. These market conditions have created fierce competition among agents, rapid innovation, and new winners and losers.

Across the board, the winners, some of which have achieved their best sales performance on record, have differentiated themselves by doubling-down on their strengths, delivering value to consumers via their expert knowledge, business network, and problem-solving-driven service. This model delivers exactly what real estate consumers desire in a high-consequence, complex transaction in times on market volatility.

Unfortunately, what consumers often experience when interacting with status quo real estate marketing and tech is the exact opposite. Instead of being an extension of the personalized, consultative experience an agent should be providing, real estate marketing and technology throw consumers into an ecosystem of generic messages and one-size-fits-all experiences.

For brokerages and agents stuck in the status quo, the client’s poor experience can be especially damaging during a low-inventory-market, leading to systematic problems including lower marketing conversion, customer attrition and commission pressure.

It is the perfect timing, therefore, for all real estate professionals to carefully examine their marketing and technology strategies to ensure that consumers are getting meaningful, personalized value.

This commitment to elevate and personalize the real estate experience is not only a solution to clear the current low-inventory logjam, but a meaningful evolution in the real estate industry itself that will pave the way for its long-term future.

Personalized vs Spray-and-Pray

Whether it’s a postcard farm, Facebook advertising, or a portal advertisement, spray-and-pray marketing methods target a loosely defined audience with a lowest-common-denominator message. Inevitably, this approach — while scalable — does little to communicate why a potential client should work with a particular agent or brand. In fact, with the exception of some of the most sophisticated, highest volume teams, most agents derive an exceedingly small portion of their business through these methods.

The tech strategy for brokerages and agents fares even worse, with many firms simply resigned to the fact that their clients will use national portals and other 3rd party controlled technologies.

It goes without saying that this provides no benefit to the brokerage and agent, and it offers a poorly personalized experience for the consumer.

Contrast these realities to what actually generates the bulk of an agent’s business: sphere of influence. When working with their sphere of influence, communication with a potential client is, by default, personalized, consultative and actionable. Agents actively provide customized data and analysis, and solve problems specific to a particular client and market. Although highly manual, these activities are what lead to high conversion rates and customer satisfaction.

In low-inventory conditions, spray-and-pray marketing and a resigned tech strategy become even less effective as competition amongst listing agents intensifies.

Even personalized, SOI tactics can get even more time-consuming as seller confidence wavers in response to increased market uncertainty and risk.

Question is, how do you create a personalized yet scalable experience for your clients?

Meaningful Personalization That’s Not Just for Show

Many existing examples of personalization have been superficial and without measurable value. Handwriting a client’s name in a mass-mailer or asking about a family member in an email are perhaps thoughtful gestures, but they don’t take advantage of the deep potential that exists in thoughtful customization of marketing and technology experiences.

Meaningful personalization starts with understanding the problems a particular client faces, whether it’s their particular property, neighborhood, financial considerations or family situation. These inputs will shape the solutions that both marketing messages and technologies should deliver, and maximizes the chances a client will respond positively.

In the current low-inventory market, any number of concerns could be top of mind for a potential home seller. Is it risky to put my home on the market? What price can I get? Will I be able to find or afford a new place to live?

These problems can be addressed in generalizations, but the more specific the solutions are, the more receptive a potential seller will be. Arguably, if more potential sellers could have their problems addressed in a personalized manner, it would have a positive effect on the market as a whole as anxieties ease and confidence grows.

Meaningful personalization will always require a human-element provided by an agent, but it also requires data and tools to deliver the rigor. That’s where RealScout’s latest product release becomes a key factor.

Scalable, Personalized Problem Solving for a Low-Inventory Market

In a low inventory market, every home seller wants extra assurance that putting a home on the market won’t be overly risky, the price attractive and the process simple. Providing personalized answers to every potential seller can seem like a daunting undertaking. Not only does the work seem highly manual, often the appropriate tools and relevant data are unavailable to both real estate professionals and consumers.

While a solution like the CMA is a good retrospective tool to illustrate how listings will perform, they can be unreliable during periods of low-inventory with reduced sample size and increased price volatility.

Brokerages can provide more real-time insights through office meetings, in-house data-collection and analysis, but this can be difficult to implement and even harder to maintain through agent and client participation.

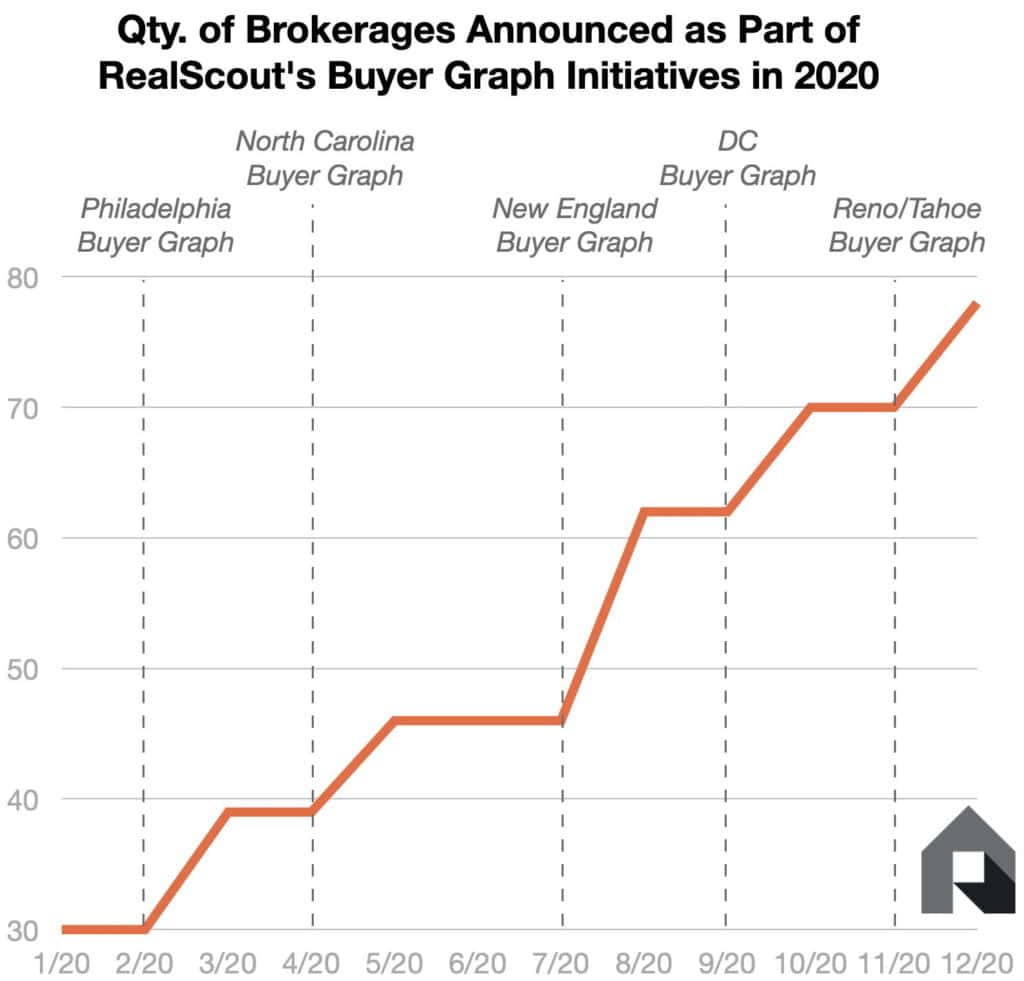

There are, however, platforms specifically designed to gain insights into serious, real-time, agent-represented demand in a particular market. RealScout’s network of brokerage and agents use RealScout’s home search platform with their clients, setting up MLS-grade search alerts. This preference and behavioral data is then anonymized and securely presented to listing agents as a way for them to assist their clients.

Market Alerts, for example, present a heatmap of homebuyer demand in a particular area, and how that demand has shifted over time.

It’s a powerful tool to keep potential sellers informed of current market demand in a very specific and relevant geographic area.

Test-the-Market takes this a step further by allowing listing agents to simulate a listing without actually putting a property on the market. Insert the basic parameters of a listing, and RealScout will provide a real-time measure of how many RealScout homebuyers would match with that listing. Furthermore, it calculates how incremental increases or decreases in listing price affects the number of matching buyers, enabling listing agents to present both an estimate for homebuyer demand as well as a data-driven pricing strategy for a particular listing.

Finally, the Reverse Prospecting feature allows listing agents to identify and reach out to buyer agents with matching homebuyers, once a listing is put on the market. This ability provides an additional, highly targeted marketing channel to the listing agent, something they can explain to potential sellers to reassure them that there are many avenues to finding the perfect buyer.

Tools, like the ones provided by RealScout, help listing agents problem-solve for their potential clients without extensive time investment, even before a listing agreement is in place. This level of personalized value-delivery is exactly what’s needed is winning competitive listings, especially during a low-inventory environment.

A Paradigm Shift in Brokering Deals

The data-driven approach to personalized problem-solving naturally extrapolates to a bigger paradigm shift in how real estate deals are brokered.

Since RealScout-powered brokerages and agents understand their clients better and at scale, that knowledge can be used not only for providing expert advice, but also for matching buyers and sellers.

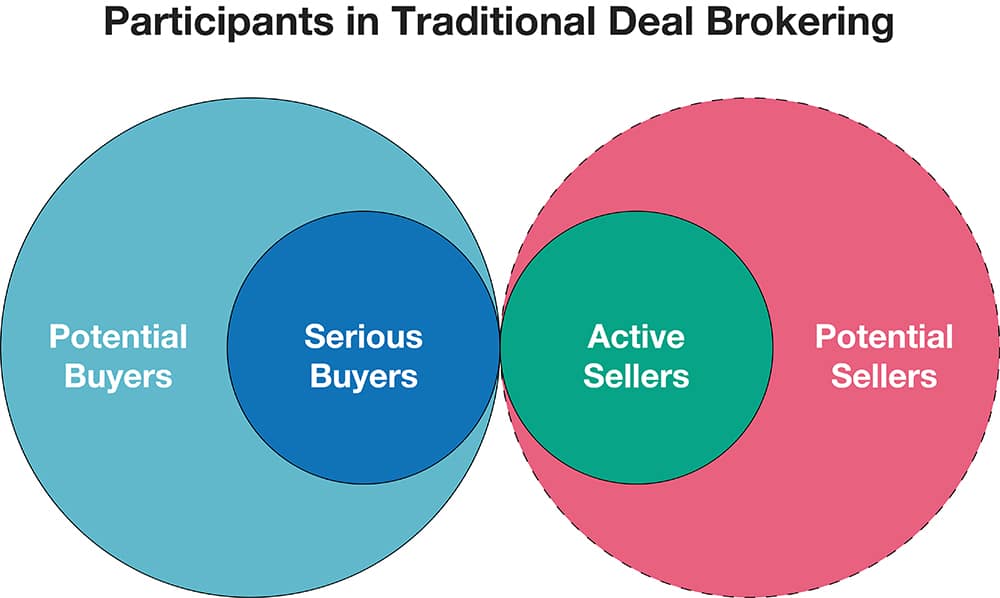

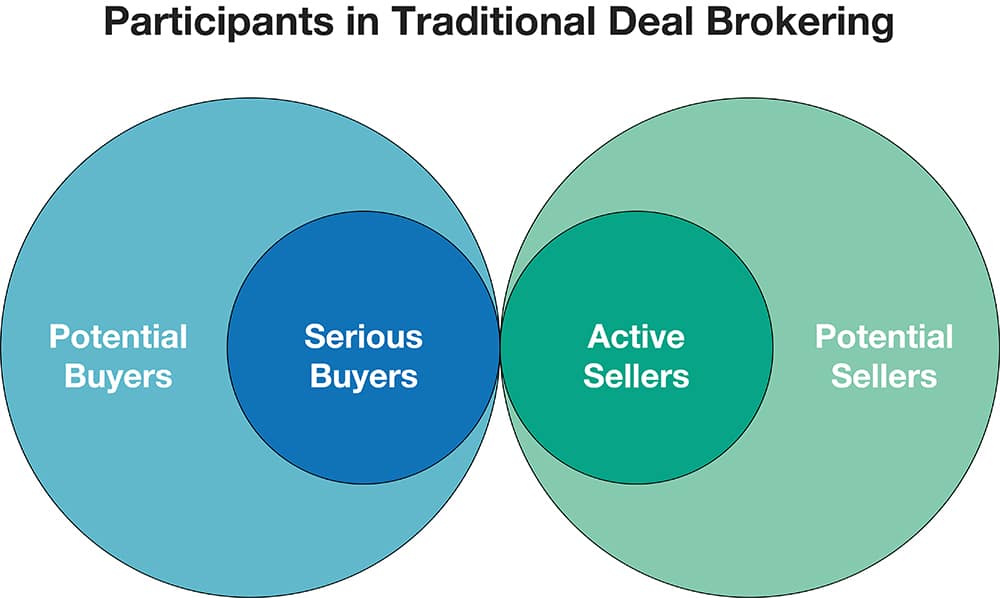

The traditional model of putting a listing on the MLS and waiting for buyers to raise their hands to express interest is an acceptably effective, if limiting method, of brokering deals. By definition, this status quo broadcast model of brokering deals applies to 2 primary groups, buyers and sellers with active listings. A deeper look reveals, however, that there’s a subtle — yet critical — asymmetry to this picture: while both serious and potential buyers can participate in this model (since listings are available to anyone), only sellers with active listings (the serious ones) can participate.

A data-driven, personalized strategy, championed by companies like RealScout, enables the excluded category of potential sellers to participate in the market in a more meaningful way.

In the same way that potential buyers can see what sort of inventory is available before they decide to jump into the market, potential sellers can preview the demand before they decide to go through the more arduous and costly process of listing their property.

Especially in a market where listings are few and far between, unlocking latent listings through broader participation can be a real boon for listing brokerages and agents. This also helps potential sellers, by allowing them to reduce the uncertainty of listing their home, not to mention buyers in the market, who will enjoy the benefits of having more inventory.

A Personalized Future

The low inventory market that we face today, personalized problem-solving is the approach that creates the transparency and confidence needed to clear the logjam. Along the way, buyers, sellers, agents and brokerages benefit through more efficient, effective workflows that lead to better outcomes for every party.

Beyond that, a commitment to better understanding clients will empower brokerages and agents to truly play the role of ‘broker,’ match-making perfect buyer-seller pairs while increasing market participation.

In fact, adopting a marketing and technology strategy that focuses on personalization is a back-to-basics moment for the industry. It seeks to turn back the years of erosion caused by impersonal online real estate marketing and technologies, and build a modern client experience that humanizes the transaction without sacrificing substance. It amplifies the value of brokerages and agents by doubling down on their strengths.

It’s a vision of the future that expands the real estate industry as a whole, and not one that disrupts it.